DETECTING BREAKOUTS FROM CHART FORMATIONS

- Chart Pattern Recognition Software Metastock Indicators Formula Sheet

- Chart Pattern Recognition Software Metastock Indicators Formula Chart

- Chart Pattern Recognition Software Metastock Indicators Formulas

You don’t have to spend countless hours any more looking at stock charts in order to identify profitable patterns.

After years of research I have finally developed the following 6 brand new metastock explorations to detect breakouts mechanically:

Bang For The Buck - Metastock Indicator Formula by MetaStock Programming Study Guide This indicator shows the possible dollar return (on a $10,000 account) for a security on any given period. This is calculated by dividing a $10,000 account by the closing price. Version R, 12/4/09: Fixed a bug in Nr4 and Nr7 pattern recognition that might effect the chart pattern indicator results. Version Q, 11/30/09: Fixed bugs in the chart pattern indicator for counts around holidays and in other routines that if they failed, could eventually cause resource problems.

Flag and pennants

Bear Flags

Rectangles (Upside breakouts)

Rectangles (downside breakouts)

Cup with handle

Break from base (BFB).

Chart Formations Explorations Bundle

$499.00

This package contains all the above metastock explorations, plus one expert and two custom indicators.

I have published four articles on these formations in Technical Analysis of STOCKS & COMMODITIES STOCKS and another three articles on breakouts.

I have since updated my original research with more recent data and used the revised statistical data to develop each exploration code.

When it comes to trading, however, nothing is certain. Identifying a specific chart pattern, doesn’t guarantee any profits because there is a high probability that the stock will fail to perform as expected.

A friend of mine purchased a metastock patttern recognition system plug-in and before using it to trade with real money he had the foresight to test it. To his dismay the test results were disastrous: The profit factor was <1.0 and profitable trades <50%.

Unlike similar systems which only identify specific chart pattern, the explorations above also use a number of indicators and conditions to filter out stocks with a high probability of failing to complete the pattern successfully.

Identifying a pattern and entering a trade, however, is only the first step. Knowing when to exit is equally important.

To calculate the profit target for some of these formations traders have relied on the measuring formula introduced for the first time in Edwards & Magee's Technical Analysis of Stock Trends, in 1948 which involves adding the formation height to the breakout price. My research has revealed, however, that this rather simple method tends to overestimate breakouts from flags and conversely underestimate rectangle breakouts. This is probably because the flag pole height is, by nature, more than double the rectangle height.

I have therefore derived a new, more realistic, measuring formula more appropriate for current market conditions, based on my original research, for trading these formations efficiently.

All explorations, therefore, include the price objective, calculated according to the new measuring formula, a stop loss, in case the stock fails to perform as expected, the risk/reward ratio and other useful statistics.

Terms and Conditions

©2011 Markos Katsanos – All rights reserved

FREQUENTLY ASKED QUESTIONS (FAQ)

Is the flag exploration the same system that you published in your article in Technical Analysis? Are you trying to sell us something that we can get free?

No this is different system. The system in the article detected flags with a constant (13 day) pole and minimum constant pole height whereas the new system takes into volatility and can therfore detect less volatile stocks which ususally have shorter poles and would have been excluded by the original system. Similarly the new rectangle system is completely different from the one that I published in my book. The old system detected only rectangles with up to 2 peaks and troughs whereas the new system will detect rectangles with unlimited number of peaks and troughs.

Are your explorations compatible with Metastock version 8.0?

All explorations are compatible with metastock version 7.2 and higher

Why don't I get any hits?

Check out the messages in the rejects column. If you see 'Results of filter formula not defined on calculation date' or 'Error in filter: Period value out of valid range' you should load more historical data before running the exploration. This is because certain explorations (rectangles and cup&handle look for formations as far as 2 years back. In addition the VFI indicator requires 260 days of data before starting producing results. As a rule of thumb you should load at least 700 days of historical data before running the explorations.

Can we return them for a refund if we are not satisfied with the results?

Is the code password protected ? Can I modify it?

Only the rectangle is password protected. This is because I spent countless hours designing this system and I wouldn't like to see it tomorrow on the Internet. You can modify all other systems

SYSTEM PERFORMANCE

Only if you convince me that you lost money using an exploration properly (ie bought at least 3 stocks and kept them for at least 3 weeks) otherwise anybody can return the installation files but continue using them for free. A sharp market correction during an unexpected geopolitical event (such a war in the Middle East or an earthquake in Japan) doesn't count. Also because a tide lifts all boats using the short explorations to short stocks during a bull market doesn't count either.

You save: $201

$100.00

PRICE LIST

or buy only you favorite chart pattern exploration

Rectangles

$100.00

Break from Base

$150.00

Cup with handle

$130.00

Flags & Pennants

Rectangles (Short)

$140.00

Bear Flags

$80.00

Buy all explorations and save $201 !!

Do you have the explorations in any other programming language except metastock?

No.

You can find below the performance statistics of the Break from Base (BFB) system. I tested the system using Tradesim Enterprise and a portfolio of 2000 US mid and small cap stocks for the 10 year period from 31/1/2001 to 31/1/2011. The trading capital used was $500,000 and $20,000 was allocated to each stock with no margin. The maximum number of open positions was 30 stocks, the commission charged was $9 per transaction, the minimum trade size was $2000 and positions were limited to a maximum of 10% of the traded volume. All Trades were held for 14 trading days and exited on the 15th day. No other exit conditions were used except a chandelier stop loss exit .

Unfortunately, because of the metastock formula language limitations, I couldn't back-test the pattern recognition systems. I can assure you ,however, from trading these systems personally that they are all profitable provided you follow these simple rules: Do not trade the long systems during a bear market and the short systems during a bull market.

Yearly profits of the BFB exploration tested on 2000 US stocks for the 10 year period from 1/31/2001-1/31/2011 with an initial capital of $500,000 and holding each stock for 15 days.

Performance of the BFB exploration tested on 2000 US stocks for the 10 year period from 1/31/2001-1/31/2011 holding each stock for 15 days.

MetaStock 17 is the latest version of MetaStock and PDSnet is proud to bring it to South Africa!

As the largest distributer of this internationally acclaimed software in South Africa, we provide a quality database of prices, an EOD download as well as support for MetaStock from our offices in Bedfordview, Johannesburg. Check out the new features for the latest version below and contact us to sign up or upgrade!

FIND WINNING SECURITIES

There are thousands of stocks, currencies, options, and futures out there. Moreover, there are hundreds of indicators and systems you might want to use to trade them. How do you even begin to sort through the possibilities? How do you find the winners? That's where the MetaStock Explorer comes in. Use YOUR criteria to scan a universe of securities to find those that fit YOUR strategy. View scan results and details on stocks after your scan has processed. Minecraft crafting dead mod download. Multiple charts can be opened at once and multiple scans can run at the same time. You may also keep the Explorer open while viewing your charts.

ANALYSE TRADING SIGNALS

The MetaStock FORECASTER offers new ways to analyse trading signals and provides insight to future performance. This tool uses patent-pending technology that uses any of 69 event recognisers - or your own custom patterns, and helps you more precisely set profit targets and stops. This a PowerTool available exclusively in MetaStock which plots a “probability cloud” based on your selection and custom pattern. It uses advanced mathematics to examine the price action after these events to determine the probable performance of future events.

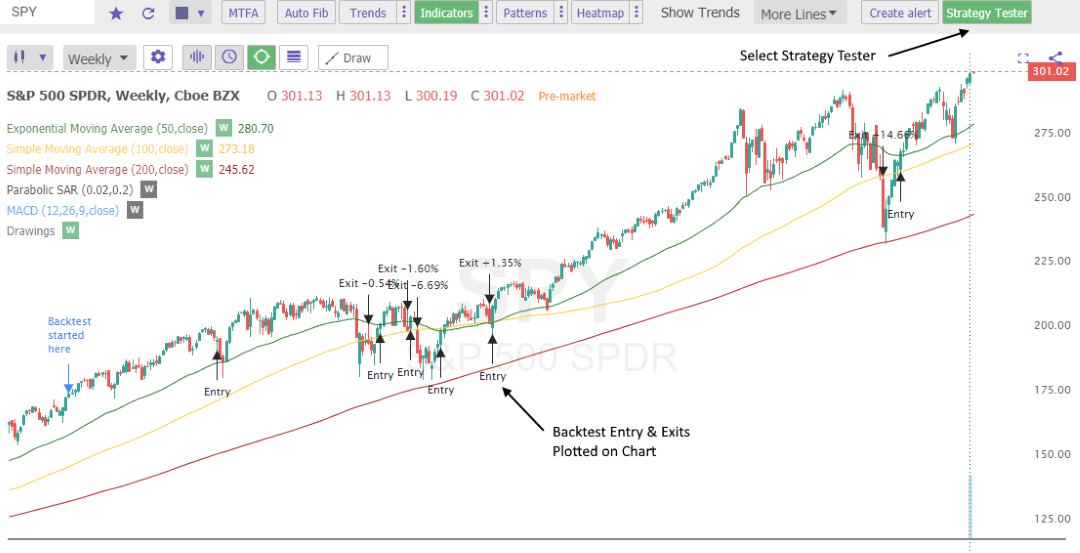

ENHANCED SYSTEM TESTER

With The Enhanced System Tester, create, back-test, compare, and perfect your strategies before you risk any of your money in the markets. The surest way to increase your confidence in a trading system is to test it historically. The Enhanced System Tester lets you take a group of stocks and compare them to a group of trading systems to find the best scenario. Designed to simulate real trading scenarios, the Enhanced System Tester allows you to change variables and gives you incredible customisation, comprehensive results, and detailed reports.

CHARTING

Use nine of the most widely-used price charting styles: bars, line, candlesticks, point & figure, kagi, renko, three-line break, equivolume and candlevolume. Page Layouts help you save time and stay organised. Save all of your on-screen charts together. Templates also save you time by applying the same set of indicators and studies to different securities. Rotate through different securities while keeping the same indicators and line studies on the screen. Built-in toolbars let you easily refresh data, change periodicity, rescale the Y-Axis, zoom in & out, choose 'previous' or 'next security' in the open folder, and choose a security to open. The Object Oriented Interface allows you to click on an object and get an instant menu for that item. The Click and Pick/Drag and Drop features let you drag price plots, indicators, text, and lines from one chart to another.

CONSULT WITH EXPERTS

The MetaStock Expert Advisor gives you the input of industry professionals when and where you need it. Display the industry's most popular systems and charting styles with the click of a mouse. Choose the commentary screen for specific information about the security you are charting. You can even create your own system using the easy-to-learn MetaStock formula language. Expert Alerts keep you in touch with current trading conditions. Use simple price and volume alerts or complex indicator triggers and multiple condition alerts. Expert Commentary shows you in great detail how your expert assesses the chart you are viewing. Expert Symbols and Trends – Buy and sell arrows, text, or any other symbols in the MetaStock palette automatically flag special conditions, according to your criteria.

INDICATORS

Analyse the market with the insight of the most respected traders in history with MetaStock's comprehensive collection of indicators and line studies – over 150 are included. MetaStock's built-in indicator interpretations even help you understand how to trade each indicator. For advanced users, The Indicator Builder lets you write your own indicators. View the complete list here. MetaStock incorporates 42 Adaptive Indicators with dynamic look-back functionality based on volatility, cycle, or a combination of both. This method provides the most responsive and accurate results. MetaStock knows that many of our clients have their own ideas about what makes a great system. The MetaStock formula language is easy to learn and allows you to create just about any system you can think of. Not into programming? You can contact Metastock and submit a formula request.

- Quick and easy workflow in the new Explorer.

- Easy to find your past scan results data in the Exploration Results Report window.

- Increase workflow even more when using multiple monitors.

- Create a list of your favourite scans. No more hassle trying to find your most used scans. You can also run them all at once.

- Create a list of your favourite back testing scans and run them all against your data for maximum results.

- No more wasting time trying to find the indicators you use most as the system by default stores the past 20 used indicators.

- Local Data of charts can now be edited.

- Scan for candlestick patterns.

- New Sector Stat templates & Indicators.

- Dynamic tool makes drawing Support & Resistance lines far more easy.

Watch this video to see what's new in MetaStock 17.

Chart Pattern Recognition Software Metastock Indicators Formula Sheet

Once you have purchased the software or the upgrade to MetaStock 17 from us, we will supply you with a historical database going back to 1985. In order to get you setup with this, please feel free to contact our support division as they have been trained on how to seamlessly assist you in getting your software up and running.

Metastock EOD Data Subscription: R275 per month.

Data subscription includes historical database of prices going back to 1985.

Chart Pattern Recognition Software Metastock Indicators Formula Chart

MetaStock Real Time (formerly MetaStock Pro) is specifically designed for real-time traders who use intra-day data to transact in real-time throughout the trading day.

Chart Pattern Recognition Software Metastock Indicators Formulas

Whether you trade stocks, bonds, mutual funds, futures, commodities, FOREX, or indices, MetaStock has the tools you need for superior market analysis and financial success.

Contact PDSnet for pricing and to help you get set up.